“Shoppers in every income bracket are facing budgetary pressures, and they are making different choices when it comes to the foods they purchase,” said Leslie G. Sarasin, FMI president and chief executive officer. “The recession is affecting shopper decision making in ways that may endure. Retailers are challenged with a great opportunity to win over shoppers with money-saving ideas that appeal to their customers.”

Consumers Adopting New Behavior to Save on Food

Shoppers are economizing when it comes to food purchases. Trends identified three stages of consumer behavior:

- Stage One — Shoppers save money on eating out by switching from fine dining to fast food. They also seek supermarket meal solutions in place of restaurant fare.

- Stage Two — Consumers change their saving measures in the store by buying more private brands, using coupons, buying basic ingredients and shopping with a plan.

- Stage Three — Shoppers switch store formats and choose supercenters, warehouse clubs and limited assortment stores.

A majority of consumers (69 percent) say they are eating out less. An additional 50 percent are eating out at less expensive places.

When deciding how to save money on their grocery bill, consumers are making plans before heading to the supermarket, resulting in fewer impulse purchases. In fact, 53 percent say they make a shopping list, 40 percent search newspaper or advertising inserts, and 35 percent report they look for coupons in the mail, newspapers and magazines.

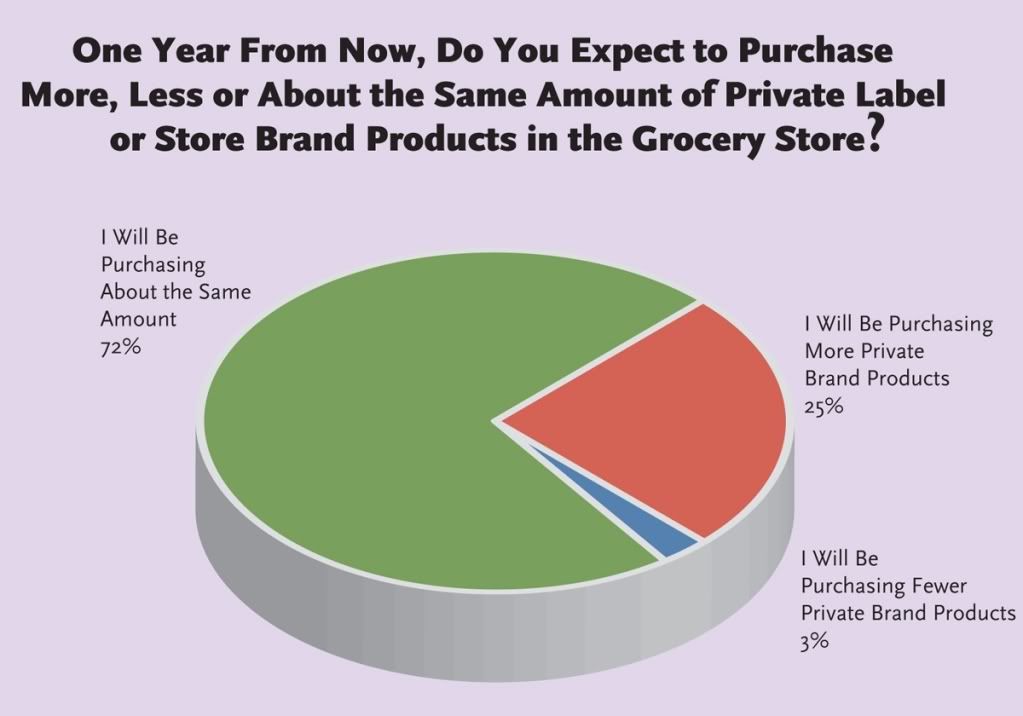

The effort to save money continues once they are in the store. The popularity of private brands continues to grow with 97 percent of shoppers saying they plan to purchase the same amount of private brands or more during the next year. (See Figure 1.)

(FMI will host a Private Brands Summit to bring industry leaders together to address strategic opportunities in private brands. It will be held this June 14-16 in New York.)

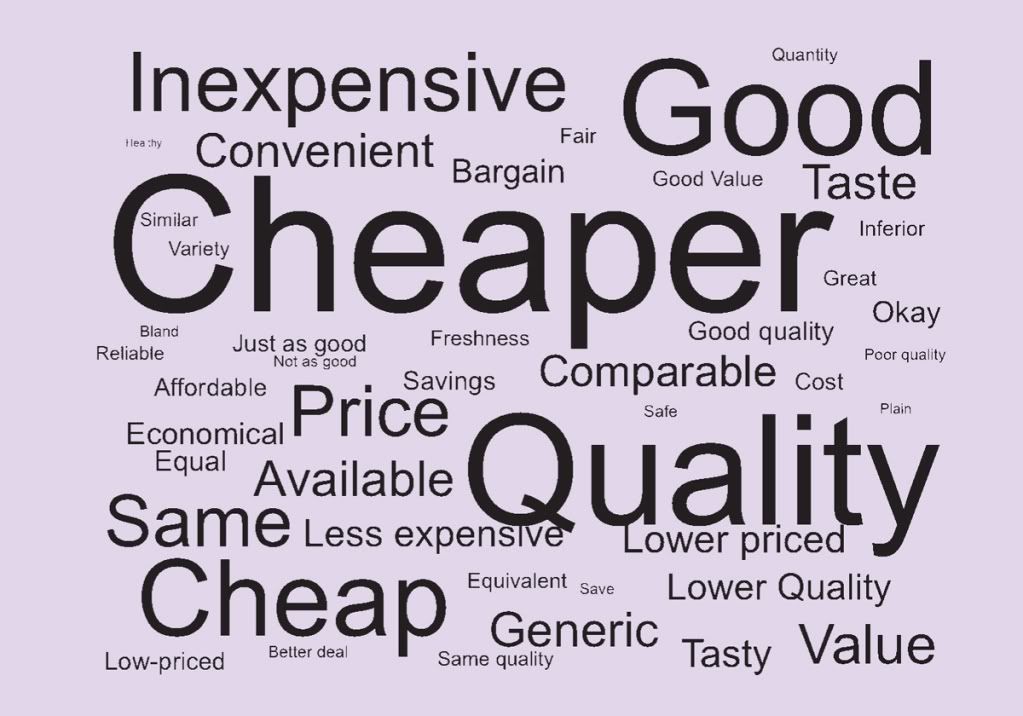

Retailers understand the importance of marketing private brand products. Some stores are conducting in-store comparison tests to measure shoppers’ preference for store brands versus national brand alternatives. Words associated with private products in the minds of consumers include “quality,” “value,” “cheaper” and “inexpensive.” Shoppers view private brands as a value-added offering in tough economic times. (See Figure 2.)

Price and Value Are Important to Shoppers

“Shoppers are focused on finding the best prices for the food they purchase,” said Sarasin. “It is the number one reason consumers pick which stores they shop at to stock up and which ones they choose for fill-in trips.”

Full-service supermarkets were identified by 56 percent of shoppers as their primary store, down from 60 percent last year. Customers are loyal to their primary store with only 6 percent saying they switched stores to save money on groceries, but when it comes to making a secondary trip, 42 percent of shoppers occasionally shop at other stores such as supercenters and warehouse stores to take advantage of specials. Supercenters have 27 percent of the market share when it comes to grocery shopping and are steadily increasing their share from 22 percent in 2005.

Most shoppers say they frequent a full-service supermarket either fairly often (31 percent) or almost every time (44 percent). Supercenters are the second most popular format, visited regularly by 39 percent of consumers.

The most price-sensitive shoppers report making more frequent trips to the store (2.3 weekly visits versus the average of 2.0 trips) to take advantage of the specials offered at different retail formats.

More than three-quarters of shoppers (76 percent) almost always check the price of a product before they decide to purchase it for the first time.

Consumers spend an average of $98.40 weekly on groceries, up slightly from $97.80 in 2008. However, this increase is offset by the 5.7 percent food-at-home inflation rate.

Advantages of Eating at Home — Healthier Meals and Costs Less

“The recession has brought consumers home — 55 percent say they are preparing more meals at home than last year,” said Sarasin. “Preparing meals at home is the best way to control food costs and ensure healthy eating.”

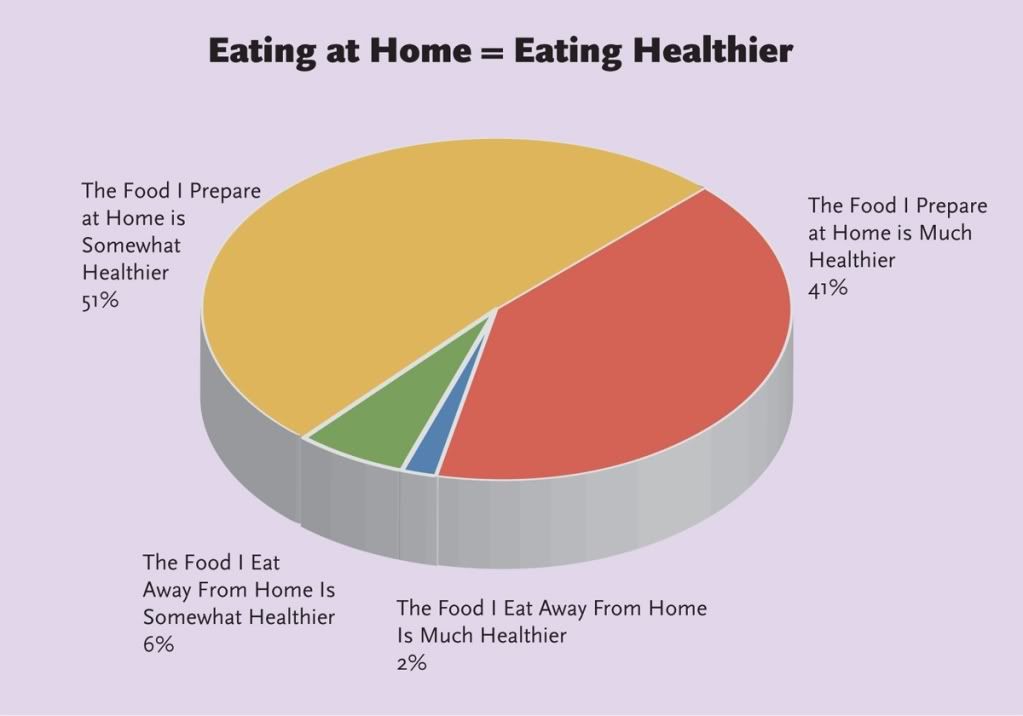

Consumers say they are concerned about the nutritional content of their food, and 92 percent say they eat healthier when dining at home. (See Figure 3.)

Shoppers admit the foods they eat at home could be healthier (57 percent), but they believe food prepared at home is better for them. Nearly three-quarters of consumers say food they consume away from home could be somewhat (48 percent) or a lot (24 percent) healthier.

Consumers seek time-saving, affordable and healthy choices for mealtime. They are most interested in:

- Easy-to-make recipes (48 percent).

- Recipes for cooking a meal for $10 or less (44 percent).<.li>

- Convenient placement in the store for dinner items such as pasta, sauce, bread, meat and salad (28 percent).

Retailers are providing tools and information on their websites and in their stores to help customers make healthy choices at the supermarket, including:

- Nutrition and health information (71 percent).

- In-store pharmacists (70 percent) to provide health and wellness advice.

- In-store health clinics (8 percent).

- Dietitians or nutritionists (6 percent).

Consumer Confidence in Food Safety Remains Fragile

A majority of shoppers (83 percent) say they are either “somewhat” or “very confident” in the safety of food in the supermarket. However, this level of confidence is fragile because 72 percent say they are only “somewhat” confident. The report also found that nearly one-third (31 percent) of consumers stopped purchasing a food product because of safety concerns.

Consumers are more comfortable with food produced or grown in the U.S. than imported products: 90 percent of shoppers are either very or somewhat comfortable with U.S. foods compared with only 42 percent for foreign foods.

Unchanged from 2008, the majority of shoppers (89 percent) trust grocery stores to sell safe food but hold less trust in the government to make sure the food they purchase is safe: 79 percent agree with the statement, “I trust the United States Department of Agriculture (USDA) to ensure that the food I purchase is safe,” and 76 percent expressed the same view about the Food and Drug Administration (FDA).

“The most important goal of America’s food retailers and wholesalers is to sell safe products,” said Sarasin. “We actively work with the government and all partners in the supply chain to collaboratively undertake the responsibility to protect the safety of the food supply.”

“Supermarkets are in a unique position to help restore consumer confidence in the safety of food because they can enhance change in several areas: consumer education, supermarket operations, product recall management and improved working relationships with manufacturers and suppliers,” she said.

Retailers are working to enhance food safety in many ways including:

- Implementing safe food-handling procedures throughout the store and continuously educating store associates through programs such as FMI’s SuperSafeMark®.

- Improving the recall process by establishing electronic communication between manufacturers and retailers using the FMI Product Recall Portal, powered by GS1 US (formerly the Uniform Code Council).

- Request suppliers to become audited through recognized, accredited certification programs such as FMI’s Safe Quality Food (SQF) to ensure suppliers comply with international and domestic food safety regulations.

- Participating in the Partnership for Food Safety Education, which brings together consumer groups, federal agencies and industry associations to develop food safety education programs for consumers.

Consumer Interest in Locally Grown Products and Sustainability

Consumers continue to show strong support for locally grown products. Nearly three-quarters (72 percent) of shoppers say they purchase locally grown products on a regular basis. Some of the reasons they like to buy local:

- Freshness (82 percent).

- Support the local economy (75 percent).

- Taste (58 percent).

- Environmental impact of transporting foods across great distances (35 percent).

The economy has not had a major impact on consumer interest in sustainability. More than half (59 percent) of shoppers say retailers’ efforts in the areas of recycling and sustainability are important. The vast majority of retailers (94 percent) sell reusable shopping bags and more consumers (40 percent) are bringing their own bags when they shop for groceries. There is growing evidence that sustainability can make sound business sense, reducing costs and increasing consumer loyalty.

(FMI will hold its Sustainability Summit in San Francisco, CA, August 17-19, 2009, to bring together key stakeholders to create an opportunity for education, develop new partnerships and help the industry move forward with innovative new sustainability strategies.)

Methodology

Data for U.S. Grocery Shopper Trends 2009 were collected through surveys conducted by Harris Poll Online among a nationally representative sample of 2,040 U.S. shoppers. Respondents must have met the following requirements to participate in the survey: a minimum of 18 years of age, primary or equally shared responsibility for food shopping, and they must have shopped for groceries in the past two weeks.

This report was made possible by the generous support of PepsiCo. To purchase a copy ($95 for FMI Retailers/Wholesaler Members, $175 for FMI Associate Members and $250 for nonmembers), contact the FMI Store at 202-220-0723 or visit www.fmi.org/store/.

Selected Charts

Figure 2. Words That Consumers Associate With Private Brand Products

Words associated with private brands in the minds of consumers show these products mean more than price alone. The cloud tag below represents the words mentioned most often by respondents to the Trends survey. The larger-sized words indicate they were mentioned more frequently than the smaller-sized words.

Figure 3.

Industry Topics address your specific area of expertise with resources, reports, events and more.

Industry Topics address your specific area of expertise with resources, reports, events and more.

Our Research covers consumer behavior and retail operation benchmarks so you can make informed business decisions.

Our Research covers consumer behavior and retail operation benchmarks so you can make informed business decisions.

Events and Education including online and in-person help you advance your food retail career.

Events and Education including online and in-person help you advance your food retail career.

Food Safety training, resources and guidance that help you create a company food safety culture.

Food Safety training, resources and guidance that help you create a company food safety culture.

Government Affairs work — federal and state — on the latest food industry policy, regulatory and legislative issues.

Government Affairs work — federal and state — on the latest food industry policy, regulatory and legislative issues.

Get Involved. From industry awards to newsletters and committees, these resources help you take advantage of your membership.

Get Involved. From industry awards to newsletters and committees, these resources help you take advantage of your membership.

Best practices, guidance documents, infographics, signage and more for the food industry on the COVID-19 pandemic.

Best practices, guidance documents, infographics, signage and more for the food industry on the COVID-19 pandemic.