By Andy Harig, Vice President, Tax, Trade, Sustainability & Policy Development, FMI, and Dr. Ricky Volpe, Associate Professor, Agribusiness, Cal Poly

Food is one of the things that we all purchase far more frequently than other products. We often visit the grocery store several times each week, while we may buy gas once a week and pay our rent or mortgage once a month. Food is a necessity that can’t easily be reduced or delayed, so it’s no wonder that we notice when our grocery bill increases. It stands to reason that food prices would receive significant attention in the media and from government, which has undoubtedly impacted consumer perceptions around food.

While we would never minimize the impact higher food prices have had on people’s lives, it’s important to look at what the data says about the true drivers of food price inflation. I recently spoke with Dr. Ricky Volpe, professor of agribusiness at Cal Poly, to shed some light on what we call the “black box” of factors impacting the price of food.

Andy: Ricky, what’s your take on the media coverage surrounding food prices?

Ricky: Recent media coverage surrounding inflation's impact on food prices often doesn't reflect the economic subtleties and nuances that influence the real cost of food in America. While claims of runaway profits and so-called shrinkflation generate clickbait for politicians that play well in the media, as an economist, I think it is critical to examine the full spectrum of economic data and trends available to construct a more accurate view into what drives food costs and the impacts on consumers.

Andy: So, what context do you believe is being left out of the current conversation?

Ricky: I think that the prevailing narratives about food inflation do not consider how wage increases over the last several years have kept pace with food price increases. While it's true that the actual price of some items, when adjusted for the value of the US dollar, are higher now than before the COVID-19 pandemic, wages have also increased significantly during that time, meaning that even though food at the grocery store may cost more, it has remained affordable given that consumers are also earning more.

If we look at the U.S. Bureau of Economic Analysis Personal Disposable Income data, which measures the average amount of after-tax income, American households’ average personal income increased 28% from March 2020 to June 2024. Over that same period, the price of food at the grocery store increased 24.6%, according to the Consumer Price Index (CPI) food-at-home data, which is the best metric for measuring grocery price inflation. While shoppers understandably bemoan price increases of staples they purchase on a weekly basis, the underlying data shows that the cost of groceries for shoppers has decreased by nearly two percentage points over the last four years, relative to wages. This has allowed consumer demand to remain high and families to meet their grocery needs even as prices have increased.

Andy: That makes sense, and it lines up with what we’re seeing in FMI’s own research. However, prices are higher for some items at the store. Why is that?

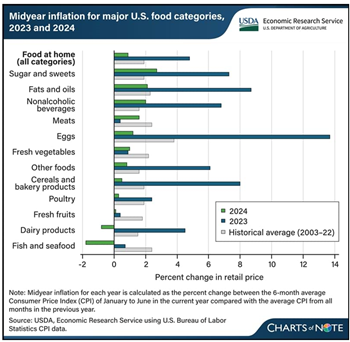

Ricky: It’s important to note the main drivers of food price increases to dispel misperceptions about the causes of inflation. The truth is that when producer costs go up, consumer prices go up too—this is standard market dynamics. There are certain structural challenges that the food industry has faced for a long time that became even more apparent during the COVID-19 pandemic. First, transportation challenges including a shortage of truck drivers and limited refrigerated truck capacity have led to higher transportation costs. In the food industry, the vast majority of products are transported by truck at least at some point, so these challenges place significant upward pressure on supply chain costs.

Second, labor costs continue to be difficult to manage. A scarcity of workers has driven wages up. This is certainly good for workers, but it produces additional cost pressures in the system that lead to higher consumer food prices. High turnover rates also create business costs associated with the hiring and training of new employees, which creates yet more costs for manufacturers and retailers.

Third, we can’t ignore the impact of severe weather events on commodities. When a flood, wildfire or drought decimates a certain region of the country, crop yields are diminished and supply is reduced, which further drives up prices.

The data shows that the supply chain is under significant cost pressures relative to food prices. Looking at the food manufacturing Producer Price Index (PPI), which measures the prices businesses pay for the goods and services required to make their products, and the Food at Home CPI between March 2020 and June 2024, an interesting trend emerges. Consumer prices rose slightly less than producer input costs, with groceries up 25.3% while producer costs were up 28%. This suggests that not only are grocers absorbing a portion of the supply chain cost increases, but also that the prices consumers pay are not the result of runaway profits. Rather, they are due to inflationary pressures throughout the entire supply chain that increase costs for businesses producing and selling food.

Andy: So, part of what you’re seeing is elevated upstream costs? Who is ultimately absorbing these increases?

Ricky: Indeed. If you look closer into the PPI data, you’ll see that most measures of upstream costs have increased more in percentage terms than related consumer prices since the onset of COVID-19. There are examples where input costs have risen significantly more than the prices for these goods on the store shelf. Fruit and vegetable producer costs are up 37.1% while consumer prices are up only 16.2% - a difference of 20.9% - indicating that the supply chain is absorbing a large portion of the input costs to avoid passing significant price hikes on to consumers.

Andy: Looking past the hype and misinformation, how would you sum up the current economic climate surrounding the price of food at the grocery store?

Ricky: I would say that yes, it remains true that inflation has caused food prices to rise at a faster rate the last few years than we've experienced over the past several decades, which can understandably lead to sticker shock for shoppers at checkout. While the narrative about food prices can be difficult to fully capture, when you really examine the data, it is also true that higher input costs are one of the main drivers of food price inflation – not profiteering on the part of grocery stores.

Andy: Thank you, Ricky. Food is of course a volatile sector - which is why it is excluded from calculations of so-called “core CPI” - and bears continued monitoring. Yet, despite these supply chain costs, the food industry is incredibly competitive. Shoppers have many options for managing their grocery budgets – whether that’s shopping around at different stores, making product substitutions, or switching to private brand goods. Even as we await the July CPI numbers to be released on August 14, we remain encouraged that food inflation will continue to move in the right direction.

Industry Topics address your specific area of expertise with resources, reports, events and more.

Industry Topics address your specific area of expertise with resources, reports, events and more.

Our Research covers consumer behavior and retail operation benchmarks so you can make informed business decisions.

Our Research covers consumer behavior and retail operation benchmarks so you can make informed business decisions.

Events and Education including online and in-person help you advance your food retail career.

Events and Education including online and in-person help you advance your food retail career.

Food Safety training, resources and guidance that help you create a company food safety culture.

Food Safety training, resources and guidance that help you create a company food safety culture.

Government Affairs work — federal and state — on the latest food industry policy, regulatory and legislative issues.

Government Affairs work — federal and state — on the latest food industry policy, regulatory and legislative issues.

Get Involved. From industry awards to newsletters and committees, these resources help you take advantage of your membership.

Get Involved. From industry awards to newsletters and committees, these resources help you take advantage of your membership.

Best practices, guidance documents, infographics, signage and more for the food industry on the COVID-19 pandemic.

Best practices, guidance documents, infographics, signage and more for the food industry on the COVID-19 pandemic.